Weighted common lease time period calculation is an important monetary device for understanding the long-term commitments embedded inside an organization’s lease portfolio. It is like a snapshot, revealing the common size of time an organization is obligated to lease belongings. This perception is significant for assessing an organization’s monetary well being, making strategic choices, and even evaluating funding alternatives associated to leases.

Navigating this calculation can really feel a bit like deciphering a posh code, however understanding its underlying logic and sensible purposes is remarkably easy.

This complete information explores the multifaceted points of weighted common lease time period calculation. From foundational definitions and calculation methodologies to sensible purposes and issues, we’ll cowl all of it. We’ll delve into the mandatory knowledge necessities, highlighting the significance of accuracy and completeness. We’ll additionally look at how completely different accounting requirements impression the calculation, and illustrate the calculation with clear examples.

In the end, understanding weighted common lease time period calculation empowers you to make well-informed choices about an organization’s lease portfolio and its monetary well being.

Introduction to Weighted Common Lease Time period

The weighted common lease time period (WALT) is an important metric in monetary evaluation, significantly for corporations with important lease obligations. It supplies a snapshot of the common size of time an organization is contractually obligated to make lease funds. Understanding WALT is significant for traders and analysts looking for to evaluate an organization’s long-term monetary well being and danger profile.WALT is a key indicator of an organization’s future money outflows.

The next WALT suggests an extended dedication to lease funds, probably impacting an organization’s flexibility and total monetary place. It is not only a quantity; it is a highly effective device for evaluating the monetary well being of a enterprise and the chance inherent in its lease agreements.

Significance of WALT in Monetary Evaluation

WALT presents worthwhile insights into an organization’s lease portfolio. It helps assess the corporate’s long-term obligations and the way these obligations will have an effect on its money flows over time. This data is essential for traders and collectors evaluating the monetary power and stability of an organization. By understanding the common lease time period, traders can higher gauge the predictability and sustainability of an organization’s future money flows, which instantly influences their funding choices.

Frequent Makes use of of WALT in Varied Industries

WALT is relevant throughout a large spectrum of industries. Within the retail sector, WALT helps assess the size of commitments to retailer areas. In manufacturing, it signifies the length of kit leases. Even within the expertise business, WALT is significant for evaluating the common length of software program licenses or knowledge middle leases. The flexibility of WALT is clear in its capacity to be utilized throughout numerous industries and conditions.

Key Parts Required for Calculating WALT

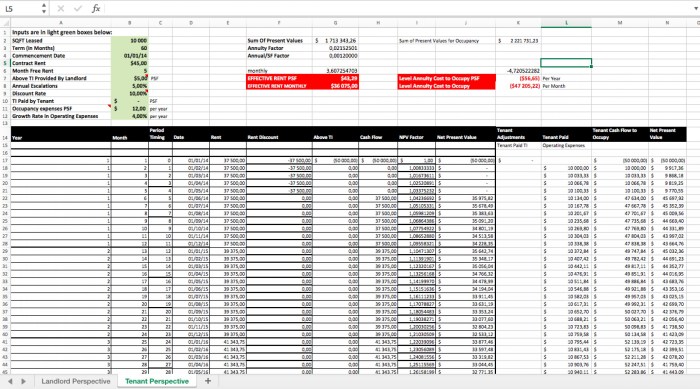

A number of components are important for correct WALT calculations. These embody the lease time period for every particular person lease settlement and the current worth of the lease funds. Precisely figuring out these parts is paramount for a exact calculation. Lease phrases differ drastically relying on the asset being leased and the precise settlement. Furthermore, the current worth of lease funds considers the time worth of cash, which is essential for a practical analysis.

Illustration of Lease Phrases and Weights

Understanding the connection between lease phrases and weights is essential to calculating WALT. The next desk demonstrates this relationship, highlighting how completely different lease phrases are assigned various weights within the calculation:

| Lease Time period (Years) | Variety of Leases | Weight (Proportion) |

|---|---|---|

| 1 | 2 | 10% |

| 2 | 3 | 15% |

| 3 | 5 | 25% |

| 4 | 4 | 20% |

| 5 | 6 | 30% |

The desk above illustrates the calculation course of. The load of every lease time period is decided by dividing the variety of leases with that particular time period by the whole variety of leases. This weighting precisely displays the proportion of complete lease obligations represented by every lease time period.

Strategies for Calculating Weighted Common Lease Time period

Unlocking the secrets and techniques of weighted common lease time period (WALT) is essential for monetary evaluation. It is a key metric used to grasp the general lease obligations of an organization, and its calculation is simple when you grasp the underlying rules. This understanding empowers higher decision-making, permitting you to evaluate the long-term implications of leasing methods.Calculating WALT supplies a snapshot of the common length of an organization’s lease agreements.

This perception is invaluable for projecting future money flows and evaluating the monetary well being of the enterprise. A transparent understanding of the methodology behind WALT is important for making knowledgeable funding choices and strategic planning.

Components for Calculating WALT

The Weighted Common Lease Time period (WALT) is calculated by multiplying the lease time period of every lease by its weight, then summing these merchandise. The formulation is a cornerstone of lease accounting and monetary evaluation.

WALT = Σ (Lease Time periodi – Weight i)

The place:* Lease Time period i represents the lease time period of a particular lease settlement.

Weighti signifies the burden assigned to that specific lease settlement.

Step-by-Step Process for Calculating WALT

Calculating WALT entails a scientific strategy, making certain accuracy and consistency. This detailed process will information you thru the method.

- Determine all lease agreements throughout the firm’s portfolio.

- Decide the lease time period for every settlement, usually expressed in years.

- Set up the burden for every lease. That is typically tied to the lease’s current worth, reflecting its significance throughout the total portfolio.

- Multiply every lease time period by its corresponding weight.

- Sum up all the outcomes from step 4.

- Divide the sum from step 5 by the whole sum of weights. This supplies the Weighted Common Lease Time period.

Strategies for Figuring out Weights in WALT Calculations

A number of approaches exist for assigning weights to lease agreements. Every methodology displays completely different views and priorities within the valuation of lease agreements.

- Lease Time period Proportion: This methodology assigns weights based mostly on the proportion of every lease’s time period relative to the whole lease phrases within the portfolio. For instance, if a lease accounts for 15% of the whole lease phrases, it will be given a weight of 15%. This strategy is simple and generally used for its simplicity.

- Lease Graduation Date: This strategy prioritizes leases that commenced extra not too long ago. These leases are sometimes thought-about extra related to the present monetary standing and are assigned larger weights. This methodology can replicate the corporate’s present leasing exercise.

- Current Worth of Lease Funds: This can be a extra refined methodology, contemplating the time worth of cash. Lease funds additional into the longer term have a decrease current worth, so this methodology assigns weights based mostly on the current worth of every lease’s future funds. This displays the monetary impression of every lease.

Comparability of Weighting Approaches

A comparative evaluation highlights the strengths and weaknesses of every weighting strategy.

| Weighting Strategy | Description | Benefits | Disadvantages |

|---|---|---|---|

| Lease Time period Proportion | Weights based mostly on lease time period proportion | Easy and easy | Does not contemplate time worth of cash |

| Lease Graduation Date | Weights based mostly on lease graduation date | Displays present leasing exercise | Could not precisely replicate the monetary impression of every lease |

| Current Worth of Lease Funds | Weights based mostly on current worth of lease funds | Considers time worth of cash | Extra complicated to calculate |

Knowledge Necessities for WALT Calculation: Weighted Common Lease Time period Calculation

Unlocking the secrets and techniques of lease phrases typically hinges on the standard of the info used. A exact Weighted Common Lease Time period (WALT) calculation calls for meticulous consideration to element, making certain correct illustration of the lease portfolio. This significant facet lays the groundwork for sound monetary evaluation and strategic decision-making.The inspiration of a dependable WALT calculation is a complete dataset containing particular lease particulars.

Understanding the format, sources, and the significance of accuracy is paramount for correct outcomes. Incomplete or inaccurate knowledge can result in deceptive conclusions, probably impacting funding choices and monetary projections.

Important Knowledge Factors

Correct WALT calculations depend on a spread of key knowledge factors meticulously collected from lease agreements. These particulars paint a vivid image of the lease portfolio’s traits. The extra full the image, the extra dependable the WALT. This necessitates cautious consideration to every knowledge ingredient.

- Lease Graduation Dates: The place to begin of every lease is essential for figuring out the lease time period. Constant and correct record-keeping of graduation dates is significant. This ensures the calculation precisely displays the precise lease durations.

- Lease Expiration Dates: Equally necessary are the termination dates. These dates, when mixed with graduation dates, permit for the calculation of lease phrases. The accuracy of those dates instantly impacts the calculated WALT.

- Lease Time period (in months): Straight derived from the graduation and expiration dates, the lease time period supplies a transparent image of every lease’s length. Consistency on this knowledge is significant for the general WALT calculation.

- Lease Quantity (if relevant): Whereas indirectly concerned within the WALT calculation itself, the lease quantity can present context and perception into the monetary implications of the leases. This data helps to grasp the potential impression of lease phrases on the general monetary well being of the enterprise.

- Lease Kind (e.g., working, finance): Figuring out the lease kind is important for correct evaluation and reporting. Completely different lease varieties could have completely different accounting therapies, so distinguishing between them is necessary for correct calculations.

Knowledge Format and Construction

A structured spreadsheet or database is good for organizing the collected lease knowledge. This standardized format ensures ease of research and prevents errors. Constant formatting permits for environment friendly knowledge import into calculation instruments.

- Spreadsheet Format: A spreadsheet, reminiscent of Microsoft Excel or Google Sheets, permits for clear group of knowledge into columns. Every column ought to symbolize a particular knowledge level (e.g., lease graduation date, expiration date, lease time period). This construction allows environment friendly sorting, filtering, and calculation of the WALT.

- Database Format: A relational database system presents superior querying and knowledge manipulation capabilities. A database permits for linking lease knowledge with different related data (e.g., property particulars, tenant data). This linked construction facilitates extra complete evaluation.

Knowledge Sources for Lease Time period Info

Correct lease knowledge is essential for a dependable WALT calculation. Varied sources contribute to this very important dataset. Fastidiously evaluating and documenting these sources is essential.

- Lease Agreements: The first supply of lease data. Thorough overview of lease agreements, taking note of graduation and expiration dates, is essential. The readability and accuracy of those paperwork decide the accuracy of the calculation.

- Lease Administration Programs: Many corporations make the most of devoted lease administration software program. These techniques usually retailer and handle lease knowledge. Utilizing these techniques streamlines knowledge assortment and reduces guide errors.

- Accounting Data: Monetary data could comprise summaries of lease phrases. This data could be worthwhile as a secondary supply to verify the accuracy of lease agreements. Evaluating the 2 sources may also help validate the info.

Significance of Knowledge Accuracy and Completeness

The standard of the info instantly impacts the reliability of the WALT calculation. Correct and full knowledge is important for knowledgeable decision-making. Inaccurate knowledge can result in important errors in projections and assessments.

- Influence on Monetary Projections: A defective WALT can skew monetary projections and forecasts, probably impacting funding choices. Cautious overview and validation of knowledge are essential.

- Reliability of Monetary Evaluation: The WALT is a key metric for monetary evaluation. Its accuracy is essential for dependable insights into the corporate’s lease portfolio. Making certain knowledge accuracy helps sound monetary assessments.

Knowledge Supply Desk

The desk beneath summarizes numerous knowledge sources and their relevance to WALT calculations.

| Knowledge Supply | Relevance to WALT |

|---|---|

| Lease Agreements | Major supply; comprises essential dates and phrases. |

| Lease Administration Programs | Streamlines knowledge assortment and reduces errors. |

| Accounting Data | Secondary supply; confirms lease phrases and particulars. |

Sensible Purposes of WALT

Unlocking the secrets and techniques of an organization’s lease portfolio, Weighted Common Lease Time period (WALT) emerges as a strong device. It is greater than only a quantity; it is a key to understanding an organization’s monetary well being and future potential. This part delves into the sensible purposes of WALT, exploring its use in numerous contexts and industries.

Assessing a Firm’s Lease Portfolio

WALT supplies a snapshot of the length of an organization’s lease obligations. By inspecting the weighted common lease time period, traders and analysts can shortly grasp the general dedication to lease agreements. An extended WALT suggests a extra substantial and longer-term dedication to leases, which might have implications for an organization’s monetary flexibility and potential future earnings. Conversely, a shorter WALT would possibly point out a extra agile strategy to lease administration, probably providing extra flexibility.

Understanding this facet is essential in evaluating an organization’s long-term monetary technique and danger profile.

Influence on Monetary Reporting and Evaluation

WALT considerably influences monetary reporting, significantly within the context of lease accounting requirements. The usual requires corporations to report lease obligations on their stability sheets, and WALT performs a significant position on this course of. By contemplating the weighted common lease time period, analysts can higher perceive the timing and magnitude of future lease funds. This in flip permits for extra correct forecasts of future money flows and enhances the precision of monetary projections.

This element is important for traders to guage an organization’s monetary well being and assess the general dangers and rewards related to investing.

Evaluating Funding Alternatives Associated to Leases

WALT could be a worthwhile device in assessing funding alternatives tied to lease transactions. As an illustration, a possible investor would possibly contemplate an organization with a shorter WALT as probably much less dangerous, as the corporate’s lease obligations are more likely to be shorter-term. Conversely, an extended WALT might recommend better danger but additionally the potential for larger returns. A deep dive into WALT, together with different key monetary metrics, is essential for making knowledgeable funding choices in a posh lease panorama.

WALT in Completely different Industries

The purposes of WALT prolong throughout numerous industries. In retail, an organization with an extended WALT could be strategically positioned to keep up a powerful presence in a selected location, however might need much less flexibility in responding to evolving market tendencies. Conversely, a shorter WALT would possibly permit a retail firm to adapt extra shortly to altering market circumstances. In manufacturing, WALT would possibly replicate the long-term nature of manufacturing services and tools leases.

The issues differ drastically based mostly on the business and the precise lease phrases.

Evaluating Lease Portfolios Throughout Firms

A desk demonstrating the comparative evaluation of WALT throughout completely different corporations could be extremely insightful. A well-structured desk would current knowledge on WALT, complete lease obligations, and different related monetary metrics for every firm. This allows a transparent comparability of lease portfolio traits and potential monetary implications.

| Firm | WALT (Years) | Complete Lease Obligations (USD Thousands and thousands) | Trade |

|---|---|---|---|

| Acme Retail | 5 | 100 | Retail |

| Beta Manufacturing | 10 | 200 | Manufacturing |

| Gamma Tech | 3 | 50 | Know-how |

This desk illustrates how WALT, mixed with different knowledge factors, can be utilized to match the lease portfolios of various corporations, enabling a extra complete evaluation of their monetary positions and future prospects. Keep in mind, WALT is only one piece of the puzzle; it is best used together with different monetary indicators for a holistic view.

Issues for WALT Calculations

Precisely figuring out the Weighted Common Lease Time period (WALT) is essential for a sturdy monetary evaluation. Understanding the components influencing its calculation, together with its limitations and the impression of lease modifications, helps to make sure a extra reasonable image of an organization’s lease obligations. Ignoring these nuances can result in a skewed view of an organization’s monetary well being and future money flows.A exact WALT calculation supplies a key metric for assessing an organization’s long-term monetary commitments and forecasting future obligations.

This understanding is effective for traders, collectors, and inner stakeholders alike, offering essential perception into the corporate’s future monetary place.

Elements Influencing WALT Accuracy

A number of components can impression the precision of WALT calculations. Lease phrases, lease inception dates, and the precise nature of lease agreements are all necessary issues. Furthermore, the accuracy of the underlying knowledge used to calculate WALT is paramount.

- Knowledge High quality: Inaccurate or incomplete lease knowledge instantly impacts the accuracy of the WALT calculation. Errors in lease graduation dates, lease phrases, or lease funds will skew the outcomes. Sturdy knowledge validation procedures are important for correct calculations. As an illustration, a easy typo in a lease time period can drastically alter the weighted common.

- Lease Modifications: Adjustments to lease agreements, reminiscent of lease changes or time period extensions, can considerably impression the WALT. Failure to account for these modifications ends in a misrepresentation of the common lease time period.

- Lease Kind Variety: The combination of working leases and finance leases considerably impacts the WALT. Finance leases, with their longer phrases, have a tendency to extend the common, whereas working leases, usually shorter in length, lower it. An organization with a big portfolio of working leases could have a decrease WALT than one with a predominantly finance lease portfolio.

- Financial Situations: Financial downturns or upswings would possibly affect lease phrases. Firms could regulate lease phrases in response to market circumstances, impacting the calculated WALT. For instance, an organization would possibly renegotiate lease phrases throughout a recession, which might impression the WALT.

Limitations of Utilizing WALT in Monetary Evaluation

Whereas WALT is a worthwhile device, it has inherent limitations. It is essential to grasp these limitations to interpret the outcomes precisely.

- Static Measure: WALT supplies a snapshot of the common lease time period. It would not seize the dynamic nature of lease portfolios. An organization might need a major variety of leases expiring within the close to future, impacting future money flows, however the WALT may not replicate this quick impression.

- Ignoring Financial Elements: WALT would not account for financial adjustments that may have an effect on the lease phrases or the worth of the underlying belongings. Market fluctuations and adjustments in rates of interest can affect lease phrases.

- Hidden Assumptions: WALT calculations depend on assumptions concerning the consistency and accuracy of the lease knowledge. If these assumptions are flawed, the WALT may not precisely replicate the corporate’s lease obligations.

- Not a Complete Metric: WALT alone would not paint an entire image of an organization’s lease portfolio. Different metrics, reminiscent of lease funds, lease expense, and the character of lease obligations, ought to be thought-about alongside the WALT for a complete monetary evaluation.

Influence of Lease Modifications on WALT Calculations

Lease modifications, together with lease changes, lease time period extensions, or early termination choices, instantly affect the WALT calculation. Modifications ought to be meticulously thought-about and included to keep up the calculation’s accuracy.

- Influence of Modifications: Modifications to lease agreements, like extensions or lease adjustments, have to be thought-about in WALT calculations. This necessitates correct record-keeping and well timed updates to the lease knowledge.

- Strategies for Accounting: Lease modification accounting guidelines dictate how modifications have an effect on the WALT. Adjustments in lease phrases require adjusting the WALT to replicate the modified phrases.

- Influence on Monetary Reporting: Correct WALT calculation is important for clear monetary reporting. Inaccurate reporting as a consequence of ignored modifications can mislead stakeholders.

Influence of Completely different Lease Sorts on WALT

The kind of lease considerably impacts the WALT. Working leases usually have shorter phrases, resulting in a decrease WALT, whereas finance leases, with their longer phrases, lead to the next WALT.

- Working Leases: These leases, usually shorter-term, lead to a decrease WALT in comparison with finance leases.

- Finance Leases: These leases, usually longer-term, lead to the next WALT in comparison with working leases.

Potential Limitations and Mitigation Methods

| Potential Limitation | Mitigation Technique |

|---|---|

| Inaccurate knowledge | Sturdy knowledge validation procedures, common audits, and constant lease knowledge entry |

| Lease modifications | Common overview of lease agreements, and well timed updates to the WALT calculation |

| Static nature of WALT | Complement WALT with different lease metrics and money movement evaluation to get a dynamic view of lease obligations |

| Ignoring financial components | Analyzing lease phrases together with financial tendencies and business benchmarks |

Illustrative Examples and Eventualities

Let’s dive into some real-world examples to solidify your understanding of weighted common lease time period (WALT). Think about you are a enterprise analyst making an attempt to evaluate the long-term implications of an organization’s leasing technique. WALT supplies an important snapshot, serving to you perceive the common size of time leases will likely be in impact.Understanding WALT calculations helps companies make knowledgeable choices about investments, financing, and future projections.

It is not nearly numbers; it is about understanding the longer term obligations related to an organization’s lease portfolio.

Hypothetical WALT Calculation Instance

This instance makes use of simplified knowledge as an instance the calculation course of. An organization has three leases:Lease 1: 5-year time period, $10,000 annual lease paymentLease 2: 3-year time period, $15,000 annual lease paymentLease 3: 7-year time period, $20,000 annual lease paymentTo calculate WALT, first decide the current worth of every lease. Assuming a reduction charge of 5%, the current values are roughly:Lease 1: $47,100Lease 2: $40,600Lease 3: $85,500Next, sum the current values of every lease: $47,100 + $40,600 + $85,500 = $173,200.Then, sum the lease phrases (in years): 5 + 3 + 7 = 15 years.Lastly, divide the sum of the current values by the sum of the lease phrases: $173,200 / 15 = 11,546.67.

Weighted Common Lease Time period (WALT) = (Sum of Current Values of Leases) / (Sum of Lease Phrases)

This firm’s WALT is roughly 11.55 years. This means the common size of time its leases are anticipated to run.

Lease Modifications Impacting WALT

Lease modifications can considerably alter the WALT calculation. Take into account a state of affairs the place one of many above leases (Lease 1) is prolonged by two years. This extension will increase the lease time period from 5 years to 7 years. The current worth of this lease can even change, reflecting the long run. The recalculated WALT will replicate this modification, displaying an extended common lease time period.

Influence of Completely different Lease Phrases

Completely different lease phrases instantly affect the weighted common. Leases with longer phrases contribute extra to the general weighted common than leases with shorter phrases. As an illustration, a 10-year lease could have a extra substantial impression on the weighted common than a 2-year lease, all different components being equal.

Calculating WALT for a Portfolio of Leases

Calculating WALT for a portfolio of leases entails contemplating every lease’s particular person time period and current worth. The method is basically the identical as within the instance above, however with extra leases to account for. The essential facet is to precisely decide the current worth of every lease, contemplating components just like the low cost charge and lease funds.

Influence of Lease Modifications on WALT Calculation

A desk demonstrating the impression of lease modifications is essential for understanding how adjustments in lease phrases have an effect on the WALT.

| Lease | Authentic Time period (Years) | Modified Time period (Years) | Influence on WALT (Years) |

|---|---|---|---|

| Lease 1 | 5 | 7 | Elevated by 2 |

| Lease 2 | 3 | 3 | No change |

| Lease 3 | 7 | 7 | No change |

This desk illustrates how a single lease modification can alter the weighted common. The impression on the WALT is instantly associated to the size of the modification.

WALT Calculation in Completely different Accounting Requirements

Navigating the world of lease accounting can really feel like navigating a maze, particularly when completely different accounting requirements come into play. Understanding how weighted common lease phrases (WALT) are calculated underneath numerous requirements is essential for correct monetary reporting and insightful evaluation. Completely different requirements typically result in completely different outcomes, impacting the best way corporations current their lease obligations.This part delves into the nuances of WALT calculations underneath Worldwide Monetary Reporting Requirements (IFRS) and Typically Accepted Accounting Ideas (GAAP), highlighting their similarities and variations, and providing sensible examples.

Applicability of WALT Calculation

WALT calculations are important for corporations reporting lease obligations underneath each IFRS and GAAP. These calculations present a key metric for evaluating the lease portfolio’s length and the impression on the corporate’s monetary statements. By evaluating WALT underneath completely different requirements, corporations can higher perceive the potential results on their monetary place and efficiency.

Comparability of WALT Calculation Strategies, Weighted common lease time period calculation

The strategies for calculating WALT underneath IFRS and GAAP are basically related however could differ in some particular points. Each requirements emphasize contemplating the timing and quantities of lease funds.

IFRS and GAAP WALT Calculation Examples

Let’s illustrate the variations with a easy instance. Take into account an organization with two leases:

- Lease A: 5 years, $10,000 per 12 months, commencing instantly.

- Lease B: 3 years, $15,000 per 12 months, commencing in 12 months 2.

Calculating WALT underneath IFRS entails contemplating the current worth of the lease funds, whereas GAAP usually makes use of a less complicated strategy.

| Lease | Lease Time period (Years) | Annual Fee | Current Worth (IFRS) | Weighted Issue (IFRS) | Weighted Issue (GAAP) |

|---|---|---|---|---|---|

| Lease A | 5 | $10,000 | $40,000 (assuming 10% low cost charge) | 0.40 | 0.40 |

| Lease B | 3 | $15,000 | $38,250 (assuming 10% low cost charge) | 0.38 | 0.38 |

| WALT | 0.78 years | 0.78 years |

Notice: The current worth calculation underneath IFRS displays the time worth of cash, whereas GAAP typically makes use of a less complicated weighted common strategy. The instance assumes a ten% low cost charge for illustrative functions; in apply, the suitable low cost charge would depend upon the precise lease and the corporate’s value of capital.

Influence of Accounting Requirements on WALT Calculations

The instance above demonstrates how the timing of lease funds and the usage of current worth have an effect on WALT underneath IFRS. Whereas the weighted common lease phrases could seem related on this instance, the underlying calculations differ. The distinction in current worth calculations can considerably impression the general WALT, significantly for leases with complicated cost constructions or lengthy durations.

Variations in WALT Presentation in Monetary Statements

The presentation of WALT in monetary statements underneath IFRS and GAAP could differ. IFRS usually supplies extra detailed disclosures concerning the lease portfolio, together with breakdowns by lease time period and kind. GAAP could present a extra summarized view, counting on mixture figures for lease obligations. These variations necessitate cautious evaluation to match the lease portfolios throughout completely different corporations utilizing completely different requirements.